After launching in the US last year, Apple’s Tap to Pay is now rolling out in the UK. This functionality allows retailers to use iPhones as mobile point-of-sales terminals. All you need to do is download and set up the appropriate mobile app, and you can start accepting digital wallets and credit and debit card payments on your iPhone without any additional hardware.

However, as a retailer, you need at least an Apple iPhone Xs or newer to use Tap to Pay. As usual you can get the right paid app from the App Store. The service will initially work with payment platforms Revolut and Tyl by Natwest, and will be available in Apple Stores across the UK in the coming weeks. Also on the roadmap is support for Adian, Dojo, MyPOS, Stripe, SumUp, Viva Wallet, Worldline and Jettle by PayPal.

“We’ve seen Tap to Pay on the iPhone transform the checkout experience for a wide variety of businesses, and we’re excited to support merchants across the UK by providing a simple, secure and private way to accept contactless payments with the power, security and convenience of an iPhone, without the need for additional hardware.

Small and medium-sized enterprises have long played an important role in the UK economy. Working with payment platforms, app developers and payment networks, we’re making it easier than ever for UK businesses to seamlessly accept contactless payments and continue to grow their business.

Jennifer Bailey, vice president of Apple Pay and Apple Wallet

Once merchants set up Tap to Pay, they can take payments from customers via NFC with a single tap. Apple offers the same data security standard as Apple Pay with secure element encryption. Specific transaction data for purchased products is not shared with Apple.

“Communicator. Entrepreneur. Introvert. Passionate problem solver. Organizer. Social media ninja.”

More Stories

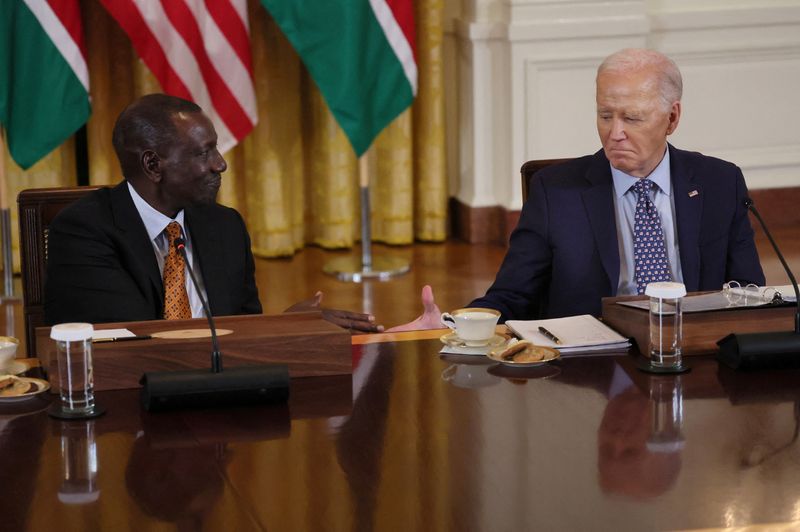

Source: US likely to designate Kenya as key non-NATO ally

Early general election in Great Britain on 4th July

The US CDC is urging states to increase flu testing this summer