The White House proposal was well received by some European countries. Other EU countries are more skeptical about this issue.

US Treasury Secretary Janet Yellen kicked off the recent debate about global minimum taxes for corporations.

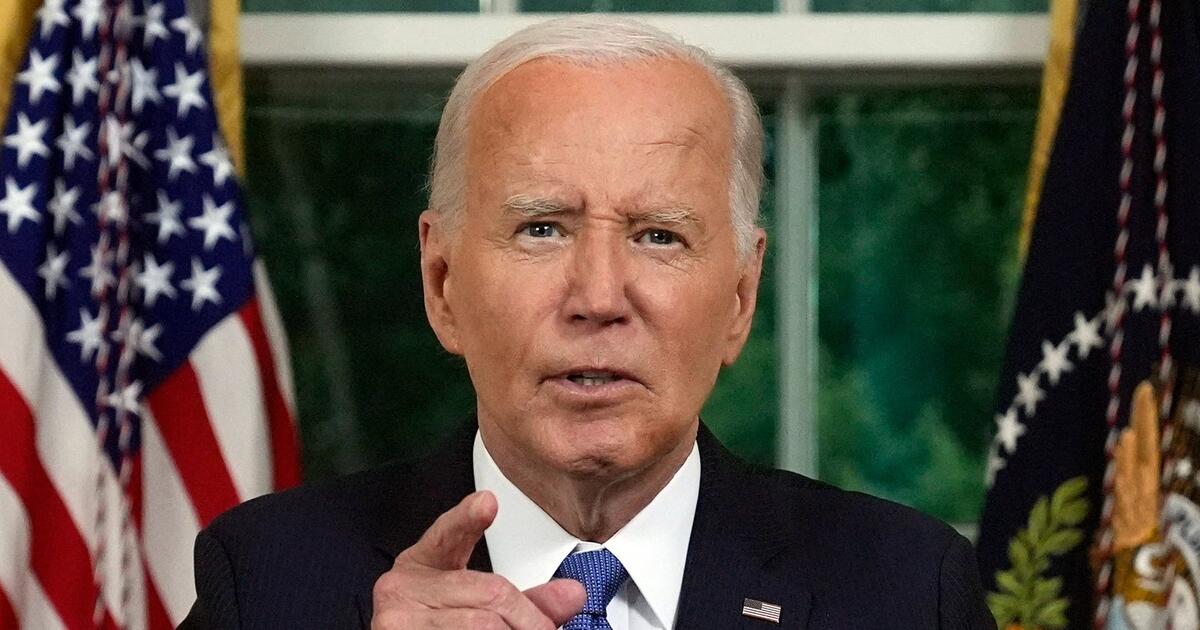

Photo: Patrick Simansky (AP / Keystone / 7. May 2021)

The US proposal to set a floor for corporate tax worldwide has raised hopes that an agreement will be reached soon. German Finance Minister Olaf Schultz said on Friday that plans to impose a tax rate of at least 15 per cent represented a “breakthrough”. He was convinced that an agreement could now be reached in the summer. French Finance Minister Bruno Le Maire spoke of a “good compromise”.

It has struggled with minimal corporate taxes for years internationally. The background to this is the international competition for the lowest tax rates to attract companies. Additionally, there are tax evasion strategies for large companies, which often transfer profits mathematically to countries with lower tax rates. So many of the countries in which companies are already operating go empty-handed.

The US Treasury Department proposed at least a 15 percent rate on Thursday as part of talks within the Organization for Economic Cooperation and Development (OECD) and the G20. Therefore, Washington’s goal is to increase this tax rate as much as possible in the negotiations. (See topic: It endangers Switzerland’s tax haven).

Germany and France for an international solution

Speaking at the Eurozone finance ministers’ meeting in Lisbon, Schultz said the fact that, from the US point of view, “the international level should be discussed now at 15 per cent” is a “very big step forward”. This makes it “realistic” that the talks will lead to success and that an “ambitious” sentence will be agreed upon. “I think we have now reached the point where we think we will achieve it.”

French Finance Minister Le Maire said France could “live with 15 per cent”. “The main question is not the height.” The point is that in addition to the minimum taxes, a regulation is also put in place for fair taxes on digital companies. Le Maire called for political agreement on both issues at the last G20 meeting in Italy on July 9 and 10.

Germany and France have long been advocates of an international solution in Europe. Other European Union countries, such as Ireland or Luxembourg, which attract large companies with lower tax rates, are naturally more skeptical. (Read our analysis on this: Tech companies are finally required to pay).

The rate will be 15 percent lower than taxes in most European countries. In Germany this percentage is approximately 30%. By contrast, in Ireland this figure is only 12.5 per cent. Luxembourg will be well above the 15 percent rate, but it offers tax deals for large companies at much lower rates and has come under repeated criticism in recent years because some international companies pay practically no taxes there.

Luxembourg is ready to speak up

“The debate is still open,” Luxembourg Finance Minister Pierre Graminia said in Lisbon. But he was ready to talk. “As long as there is an agreed common standard for everyone, it makes life easier for everyone.”

Especially relating to large digital companies, the OECD negotiations also address the issue of whether companies should pay taxes on their profits in every country in which they are manufactured – regardless of where they are headquartered. This would primarily affect US companies.

Therefore, Washington is expected to insist that this rule be applied to all multinational companies. This could also become a problem for Germany with its large global companies, for example in the automotive sector.

Found a bug?Report now.

“Typical entrepreneur. Lifelong beer expert. Hipster-friendly internet buff. Analyst. Social media enthusiast.”

More Stories

Treasure from a Baltic Shipwreck: Champagne and Mineral Water Discovered – News

US Election Year 2024 – Trump Celebrated as Pop Star at Party Conventions – News

Donald Trump’s photo after assassination attempt: What does it mean? – News