Tuesday, August 22, 2023 at 5:19 pm

The Bank of England has warned that the proportion of businesses that will struggle to repay their debts due to rising interest rates could rise to the highest level since the financial crisis.

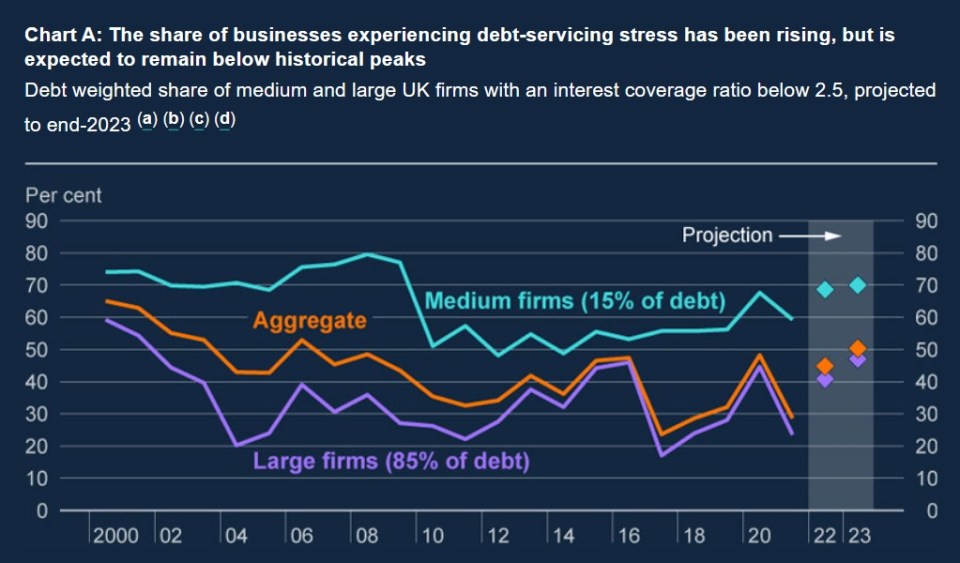

in Blog post The proportion of companies experiencing debt servicing distress is expected to rise from 45 percent in 2022 to 50 percent by the end of 2023, the central bank said, published today.

For medium-sized companies, which make up only 15 percent of the survey, 70 percent are expected to face pressure, which is marginally higher than their current level.

Small business groups complained that their needs were not taken into account.

The bank's definition of a company that will struggle revolves around the company's interest coverage ratio (ICR), which divides a company's earnings before taxes and interest by its interest expense. Companies with an ICR of less than 2.5 were placed in the “difficulty” category.

“A default could directly increase risks to financial stability by reducing lenders’ flexibility, while sharp cuts in investment and employment could indirectly affect financial stability by amplifying the overall economic downturn,” the publication warned.

Despite this increase, the bank stressed that the level of debt servicing pressure will remain below the equivalent level during the financial crisis.

She also noted that the analysis does not take into account measures companies can take to limit the impact of rising interest rates, such as reducing debt. The bank said there is some evidence that some level of corporate deleveraging is ongoing.

The data was presented to the Financial Policy Committee in the second quarter and helped shape the decisions of interest rate setters. Some business groups have raised questions about whether the bank is taking the impact of interest rate hikes on businesses seriously enough.

Martin McTague, national president of the Federation of Small Businesses (FSB), stressed that the data does not include many small businesses that are “more vulnerable” to rising interest rates than their larger counterparts.

Financial Stability Board data for the second quarter of 2023 shows that a fifth of small businesses reported financing as a major contributor to increased costs, the highest proportion on record.

“SMEs make up more than 99 per cent of all businesses in the UK, and the risks to them from rising interest rates are far from theoretical,” McTague said.

David Bharir, head of research at the British Chamber of Commerce, said the data was consistent with what “thousands of SMEs are telling us”.

“Businesses are reporting a significant increase in costs arising from repaying loans, mortgages and financing bills… They should be reassured that the Bank of England fully understands the impact of higher interest rates.”

Despite the pain that higher interest rates are inflicting on businesses, other groups have indicated that there is still support for raising interest rates.

Katie Usher, chief economist at the Institute of Directors (IoD), noted that a majority of institute members were “more concerned” about rising inflation rather than rising interest rates.

But Osher also highlighted that monetary policy is acting with a lag, raising the question of whether it would be wise to pause interest rate hikes “to avoid the risk of overshoot.”

“Alcohol buff. Troublemaker. Introvert. Student. Social media lover. Web ninja. Bacon fan. Reader.”

More Stories

“A ban would destroy seven million businesses” » Leadersnet

What are the opportunities available to the company?

Dirty Deals – Refugee deal between Great Britain and Rwanda