ClientEarth calls on lenders to justify it

Climate Protection Organization in London land customer It asked 17 international lenders on September 13, 2021 to justify their financial or advisory services to Royal Dutch Shell Plc and Siccar Point Energy, the two companies behind the Campo oil field project in the North Sea 120 kilometers west of the Shetland Islands, it says in one Explanation. Doing business with fossil companies would attract banks’ climate commitments, such as signing an agreement Net-Zero Banking Alliance and des Collective commitment to climate action, “silly”. Barclays and Deutsche Bank, two of those criticized, did not respond to requests for comment on the messages.

North Sea excavators – Photo ©

The Campo oil field project has come under fire from activists who argue that developing the field’s estimated reserves of 170 million barrels goes against UK policies to achieve net zero emissions by 2050. Preparations for the Campo field have been postponed until next year.

Scottish Prime Minister Nicola Sturgeon asked British Prime Minister Boris Johnson on September 12, 2021 not only to give approval to start production of the Campo oil field, but to re-evaluate the license. The Campo oil field was approved in 2001 and must now be allowed to start production. Sturgeon said that original decision must be re-evaluated in light of more ambitious climate goals. (Reuters)

ClientEarth: “North Sea Oil Field Development Shows Hypocrisy of Banks When It Comes to Climate”

The new Campo North Sea oil field project is owned by Shell Oil and a private equity firm called Siccar Point Energy, which has applied for a license to start oil production. The plans have sparked heated debate: If given the green light, the companies could produce up to 170 million barrels over 25 years and emit 63.5 million tons of harmful greenhouse gases in the first phase of the project alone.

It would also be one of the first proposals to gain approval since the International Energy Agency announced that there would be no new oil and gas production projects if global warming was to remain at a safe level – up to the 1.5 degree C limit. However, major banks around the world continue to support the companies behind the development of Campo. Barclays, HSBC and Standard Chartered are among the many banks that finance or advise Shell and Cicar Point and thus enable the climate damage caused by the project.

At the same time, these banks pledged to reduce their impact on the climate. They are all members of Net-Zero Banking Alliance (solarify.eu/70-billionen-pro-netto-null-emissions) or website Collective commitment to climate actionWhich means they promised to base their portfolios on achieving net zero emissions by 2050. For this reason, Client Earth wrote to the 17 banking institutions, citing their hypocrisy and inconsistency between their words and actions. These include: Bank of America, Barclays, BNP Paribas, BPCE/Natixis, Citi, Crédit Agricole, Credit Suisse, Deutsche Bank, HSBC, ING Bank, Lloyds, Morgan Stanley, Banco Santander, Société Générale, SpareBank 1 Markets, Standard Chartered and ups.

“You cannot claim that you are converting net zero while supporting clients who are driving a risky oil and gas project that clearly goes against net zero targets,” said Jamie Sawyer, attorney at ClientEarth.

On September 13, 2021, Client Earth called on financial giants to justify their support for Shell and Siccar Point in light of banks’ climate commitments and warned that continuing to do business with the companies posed significant legal, financial and reputational risks. We urge the directors of all banks that support the Campo project to justify this hypocrisy. Not only are they putting their credibility and reputation at risk, but if the project continues, they are unnecessarily exposing the bank to significant financial and legal risks, with no clear understanding of how to deal with it.”

Legal risks

As part of the Net-Zero Banking Alliance or the Collective Commitment to Climate Action, the banks promised to reduce their emissions in line with science-based decarbonization scenarios and engage their customers in the transition process. Lawyers argue that managers who break these promises run the risk of violating their fiduciary duty to contribute to their bank’s success. In addition, there is a risk that banks may breach regulatory requirements relating to risk management and fail to manage the risk of troubled assets.

If the Cambo development proposals are approved, oil production will be secured until 2050 or beyond. However, these reserves could become obsolete if new laws are passed to combat climate change. In their letters, ClientEarth’s lawyers also referred to banks’ legal obligations under international standards such as the United Nations Guiding Principles on Business and Human Rights and the Organization for Economic Co-operation and Development’s Guidelines for Multinational Corporations. This also includes contacting the Campo operators to persuade them not to pursue the proposed project and to consider terminating the business relationship if they refuse.

Regardless of the legal risks, banks can come under significant pressure from investors to withdraw funding, including through shareholder climate decisions calling for stronger climate policies and voting against managers.

Sawyer added: “The sad truth is that only the Campo oil field a An example of this is that the actions of these banks do not match their words. What should be done for these institutes to listen to the science and start asking polluting companies to immediately stop oil and gas production, or consider ending relationships with customers who refuse? It’s time for these powerful financial players to turn words into action. By not using Cambo, you have the opportunity to avoid the millions of tons of harmful emissions that further harm our fragile climate – instead, you help ensure the world is on the path to a net zero impact.”

-> Sources:

“Award-winning music trailblazer. Gamer. Lifelong alcohol enthusiast. Thinker. Passionate analyst.”

More Stories

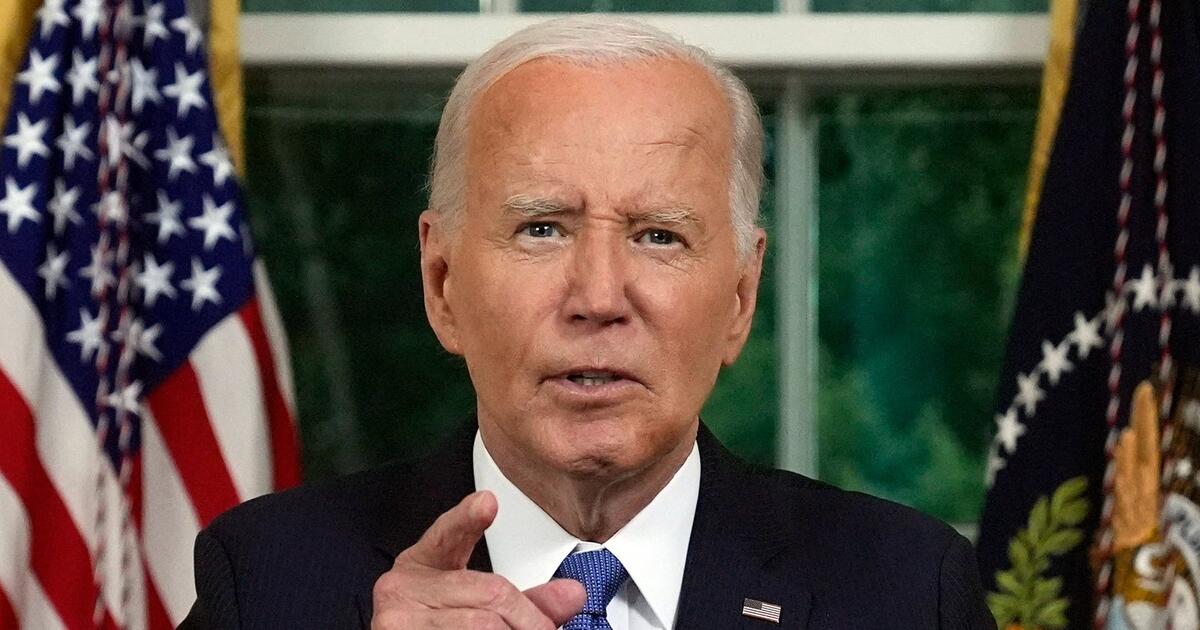

Address to the Nation: Joe Biden Explains His Resignation and Future

Harry makes serious claims in TV documentary: Will Meghan never return to UK?

’90s TV Star: Mourning Brenda: American Actress Shannen Doherty Dies – Entertainment