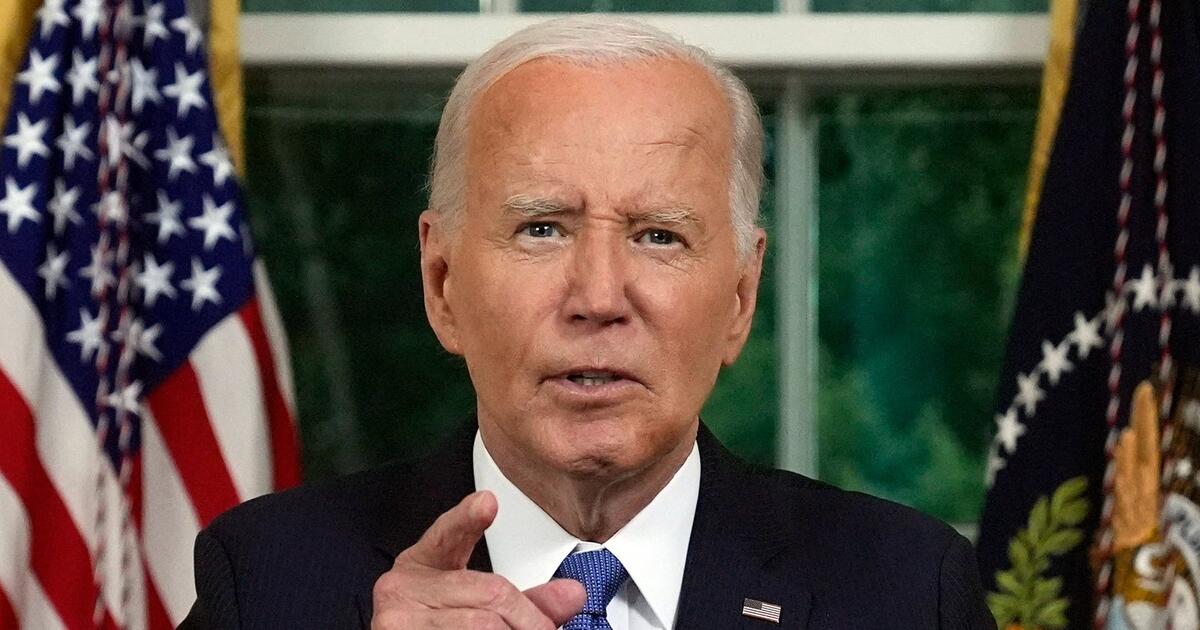

Frank Schwab

Overall, APIs can play a major role in helping banks become more competitive and customer-centric while reducing costs and improving the bottom line. There are three primary strategies on how APIs can support the bank’s digital transformation.

By Frank Schwab, Fintech Forum

1. Best partner banking services

aPI enables banks to open their products and services to their partners. By using APIs, banking products and services can be seamlessly integrated into partners’ business processes, thus greatly improving customer experience.

For example, by implementing APIs, the Spanish bank BBVA was able to integrate its products and services with partner companies, resulting in revenue growth of 20%. These partners, especially the new financial technology companies, had better access to financial information, which enabled them to develop better services. Recently, companies such as nerdwallet, Spreedly, Cardlytics, Automated Financial Systems, Execupay, and Mx Technologies have partnered with BBVA.”

Frank Schwab

Barclays has also been able to integrate its services with partner companies and significantly improve customer experience by opening its APIs to third-party developers.

In principle, all banks can benefit from offering open banking services using APIs. In addition to the standard free offering required by the EU PSD2 regulation, banks can also provide premium APIs. These enable direct income generation, minimizing risks and increasing returns.

At the end of the fourth quarter of 2022, there were 246 regulated offshore providers in the UK. Together, they are responsible for over a billion API calls per month.”

2. Increasing competitiveness through innovation

APIs allow banks to open up their systems and data to third-party developers. In this way, new financial products and services can be developed by innovative third parties. Above all, this helps large established banks to continue to innovate and stay ahead of the competition. A good example of this is Capital One’s developer platforms.

The author is Frank Schwab, co-founder of FinTech Forum

Frank Schwab He is the co-founder of the Frankfurt FinTech Forum (location), Member of the Supervisory Board of Addiko Bank in Vienna, Member of the Supervisory Board of Hauck & Aufhäuser Innovative Capital in Frankfurt, Member of the Board of Directors of Gulf International Bank in Bahrain, Member of the Risk Advisory Committee of PayU in Amsterdam and investor in cryptocurrency and European financial technology companies. His main interests are new ideas, creativity and innovation, technology and banking. Previously, he was Managing Director of GIZS (paydirekt / Sparkassen), CEO of Fidor TecS AG, President of Hufsy in Copenhagen, Senior Consultant at McKinsey & Company, Member of the Technology Advisory Board of Sberbank in Moscow and Director of Innovation at Deutsche Bank. Frank Schwab also taught for several years as a lecturer in Creativity and Innovation Management at Mannheim Business School.

Frank Schwab He is the co-founder of the Frankfurt FinTech Forum (location), Member of the Supervisory Board of Addiko Bank in Vienna, Member of the Supervisory Board of Hauck & Aufhäuser Innovative Capital in Frankfurt, Member of the Board of Directors of Gulf International Bank in Bahrain, Member of the Risk Advisory Committee of PayU in Amsterdam and investor in cryptocurrency and European financial technology companies. His main interests are new ideas, creativity and innovation, technology and banking. Previously, he was Managing Director of GIZS (paydirekt / Sparkassen), CEO of Fidor TecS AG, President of Hufsy in Copenhagen, Senior Consultant at McKinsey & Company, Member of the Technology Advisory Board of Sberbank in Moscow and Director of Innovation at Deutsche Bank. Frank Schwab also taught for several years as a lecturer in Creativity and Innovation Management at Mannheim Business School.Capital One has launched a developer platform that provides third-party APIs for developers to integrate Capital One services into their own applications. This has led to the creation of new financial products and services, such as the Digital Auto Financing Credit app. This application allows customers to submit a loan application completely online.

Reports from the Open Banking Implementation Authority (OBIE) show that more than 6.5 million bank customers are actively using open banking products in the UK.”

These products mainly provide innovative money and wealth management services to end users (individuals and small businesses).

3. Increased efficiency

By automating processes and reducing manual intervention, APIs can help banks increase operational efficiencies and reduce costs.”

For example, by implementing APIs, Wells Fargo has been able to automate many of its manual processes and lower operating costs accordingly. In particular, processes such as fraud detection, payments, and data services integrate well with Wells Fargo’s API gateways.

By using APIs to automate their operations, Bank of America has also reduced costs and improved operational efficiencies. For example, Bank of America was able to extend its cashPro payment API to provide its customers with a choice of more than 350 payment methods.Frank Schwab

“Alcohol buff. Troublemaker. Introvert. Student. Social media lover. Web ninja. Bacon fan. Reader.”

More Stories

The Body Shop files for bankruptcy in the UK

Kaspersky: All employees in the US must leave – business activities will be terminated

Resettlement in the United States and its Impact on U.S.-Focused Firms