The United States Deposit Insurance Fund (FDIC) plans to sell Silicon Valley Bank (SVB) and signature bank. Prospective purchasers are invited to submit an offer by March 17th. mentioned Reuters, citing inside information.

After regulators took over failed lenders last week, the FDIC is making a concerted effort to bring them back into the private sector.

This is already the second attempt to sell SVB. The previous two candidates, Royal Bank of Canada and PNC Financial Group Inc, withdrew on Sunday.

Banks will be sold as a whole

The upcoming sale stipulates that the two banks be taken over as a whole. Only if an acquisition does not occur are offers made for portions of the assets being considered.

Traditional institutes take precedence over private equity firms. To that end, US regulators will only allow applicants with an existing banking license to view banks’ financial reports before making an offer.

According to insiders, potential buyers of Signature will have to exit their cryptocurrency business. At the end of September, nearly 25% of the bank’s deposits came from crypto entrepreneurs.

Taxpayers are out of trouble

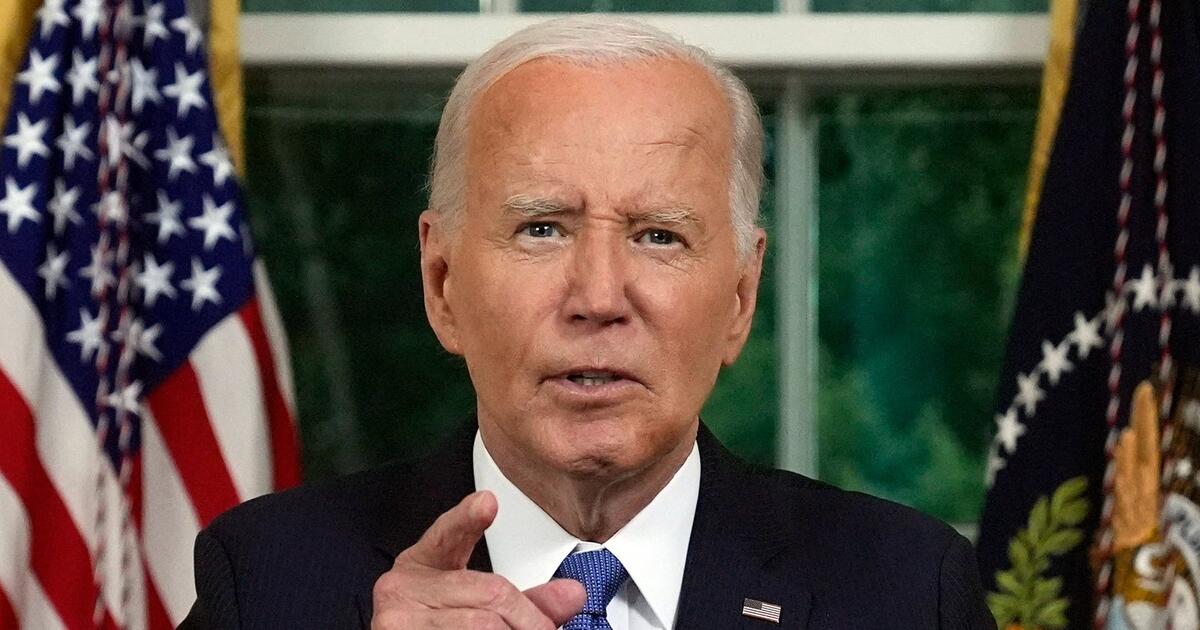

US President Joseph Biden promised taxpayers not to foot the bank bailout bill. The state fund would cover any capital shortfall and tax other banks. In the event of a successful sale, the fee is reduced.

SVB is the largest US bank to fail since the 2008 financial crisis. Its failure shook the US financial sector, raising doubts about the future of startups that relied on this bank for loans and other financial services.

SVB Financial Group, the former parent company of SVB, is filing for bankruptcy protection as one of the options to sell the remaining assets. These businesses include venture capital and the investment bank.

Regulators shut down Signature Bank on Sunday citing a lack of confidence in the bank’s management.

“Alcohol buff. Troublemaker. Introvert. Student. Social media lover. Web ninja. Bacon fan. Reader.”

More Stories

The Body Shop files for bankruptcy in the UK

Kaspersky: All employees in the US must leave – business activities will be terminated

Resettlement in the United States and its Impact on U.S.-Focused Firms