The Office of the Comptroller of the Currency (OCC) said Monday that federally regulated banks can use stablecoins to make payments and other activities.

The Federal Banking Regulator has published an explanatory letter addressing whether national banks and Federal Savings Associations can participate in Independent Contract Verification Networks (INVNs, known as blockchain networks) or use stablecoins. The message stated that these financial institutions could participate as a contract on the blockchain and store or verify payments.

Any banks participating in INVN should be aware of operational risks, compliance or fraud in doing so, the OCC press release warns.

However, the OCC said INVNs “may be more flexible than other payment networks” due to the large number of nodes needed to verify transactions, which in turn can limit tampering.

“The message is that blockchains have the same status as other global financial networks, such as SWIFT, ACH and FedWire,” Kristin Smith, CEO of the Blockchain Association, said on Twitter.

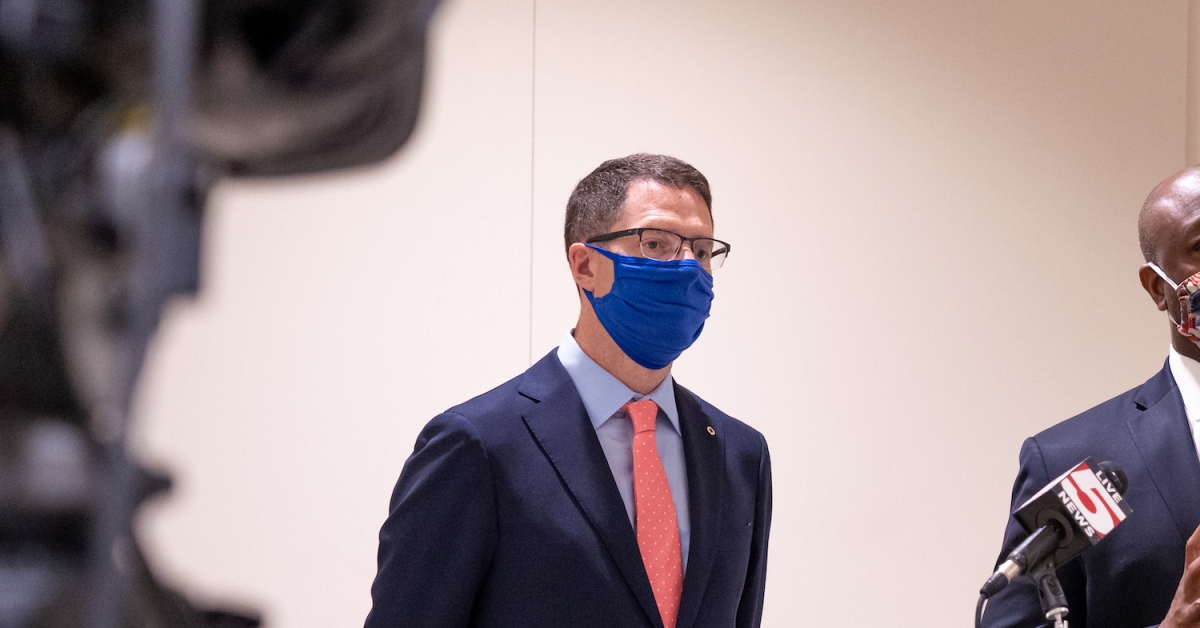

Acting currency controller, Brian Brooks, said in a statement that although other countries have built real-time payment systems, the United States has “relied” on the private sector to create such technologies, which appears to favor the use of cryptocurrencies – on the face of it. Selection Stablecoins – as an alternative to other real-time payment systems.

Brooks oversaw the publication of two other explanatory letters and a number of other cryptocurrency-friendly moves during his stewardship of the agency, including one telling federal banks that they could provide services to issuers of stablecoins and store stablecoin reserves.

Last month, Brooks announced his support for a letter from the President’s Working Group on Financial Markets that made clear how to regulate stable currencies within the United States.

President Donald Trump twice nominated Brooks to serve a full five-year term at the helm of the agency, including Earlier this week. However, it is not clear whether or not the US Senate will set a date for the vote to confirm or not, and, at press time, it does not seem likely to do so before President-elect Joe Biden takes office on January 20.

Monday’s explanatory letter also comes on the same day that the public comment period for the proposed Financial Crime Enforcement Network (FinCEN) rule closes. The controversial rule only had a 15-day suspension period and was reportedly led by Treasury Secretary Stephen Mnuchin, who appointed Brooks to the ACC in early 2020.

“[Monday’s OCC letter] It demonstrates that there is no all-out attack on cryptocurrencies, and that there are bright spots in the government realizing that crypto networks will be the basis of future payment systems and other financial services applications, so we welcome this kind of explanatory guidance, ”Smith told CoinDesk in a phone call.

Read the full message below:

“Alcohol buff. Troublemaker. Introvert. Student. Social media lover. Web ninja. Bacon fan. Reader.”

More Stories

Pun: What is the funniest brand name in the UK?

Venezuela is turning to cryptocurrencies for its oil business

Google Privacy Protection Mechanism: Insufficient data protection