Emerging economies need to be considered when transitioning to net zero emissions. (Photo: Shutterstock.com/sladkozaponi)

The race for net zero emissions is not a race between countries. It’s a race against time, says Peter Erdmanns of Ninety One magazine. The zero net investment approach urgently needs to be reconsidered. For this reason, Ninety has introduced the Net Zero Sovereign Index.

If the world is to achieve net-zero targets at the pace set by the Paris Agreement, the investor’s current approach to capital allocation must change. Ninety One’s latest white paper looks at the misinterpretation of asset managers when it comes to net-zero approaches. “These mistakes have led companies to set portfolio-wide carbon targets that would negate global net-zero ambitions,” said Peter Erdmanns, Ninety One’s head of fixed income. In response, the South African asset manager launched the Net Zero Sovereign Index, which offers government bond investors an independently verified rating based on Parisian sentiment.

A successful transition to net zero emissions requires rapid actions and adjustments in many areas. These include regulations, consumer behavior, technology – and the allocation of capital specifically to investors. There is currently an acute risk that emerging economies will withhold the funds they need to transition to net zero emissions. This, in turn, makes the transition to a “zero carbon” global economy more difficult. The current net-zero approach can have a significant negative economic and social impact on the world’s disadvantaged communities. These communities are often the hardest hit by the effects of climate change. No net-zero standards in some parts of the world means no net zero standards at all, according to Erdman.

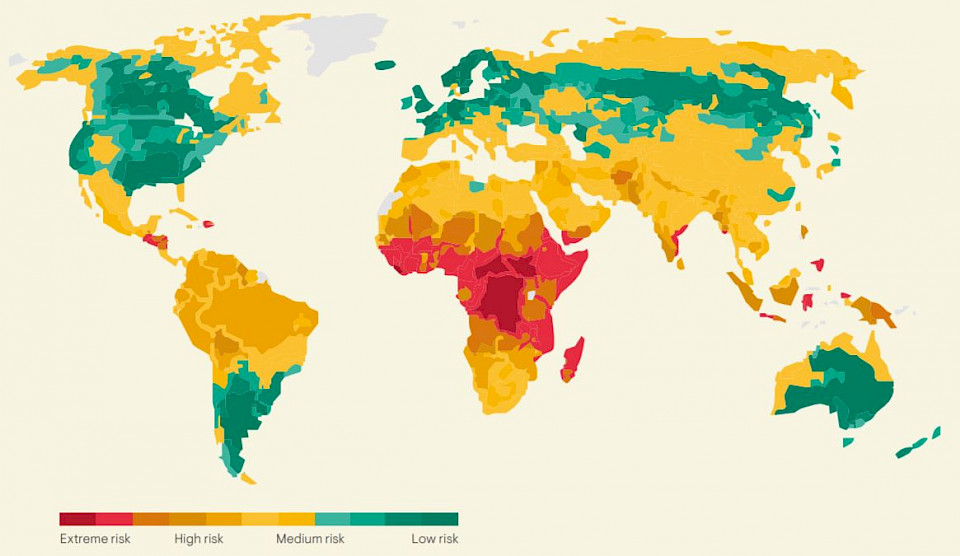

Emerging countries are generally more vulnerable to climate change than the developed world (see chart). Thus, a well-researched and forward-looking approach to net zero emissions is sorely needed. The approach must adequately take into account the context in which each country operates, its capacity to contribute to the global net zero emissions target and its specific path of transmission.

Emerging countries are hardest hit by climate change

Source: Climate Change Risk Map by Verisk Maplecroft, 2016. Please note that this map has been redrawn by Ninety One.

The first indicator with all emerging countries

The Net Zero Sovereign Index contains 115 countries in both emerging and developed markets. It is the first index to cover the full spectrum of emerging markets. The Net Zero Sovereign Index is based on the Climate and Sovereign Nature Index, introduced in 2020. It aims to encourage investor engagement with governments so that they can hold government officials accountable and promote positive change.

“Investors need better benchmarks to be able to build fair net-zero portfolios,” Erdmann added. With the Net Zero Sovereign Index you can prove that your government bond portfolios are based on the Paris Agreement and are on a reliable path to achieving the net zero emissions target. “We believe that the index supports a fair transition in emerging markets and that it will help government bond investors in holding governments accountable for their climate policies and actions.”

Emerging markets are doing better than expected

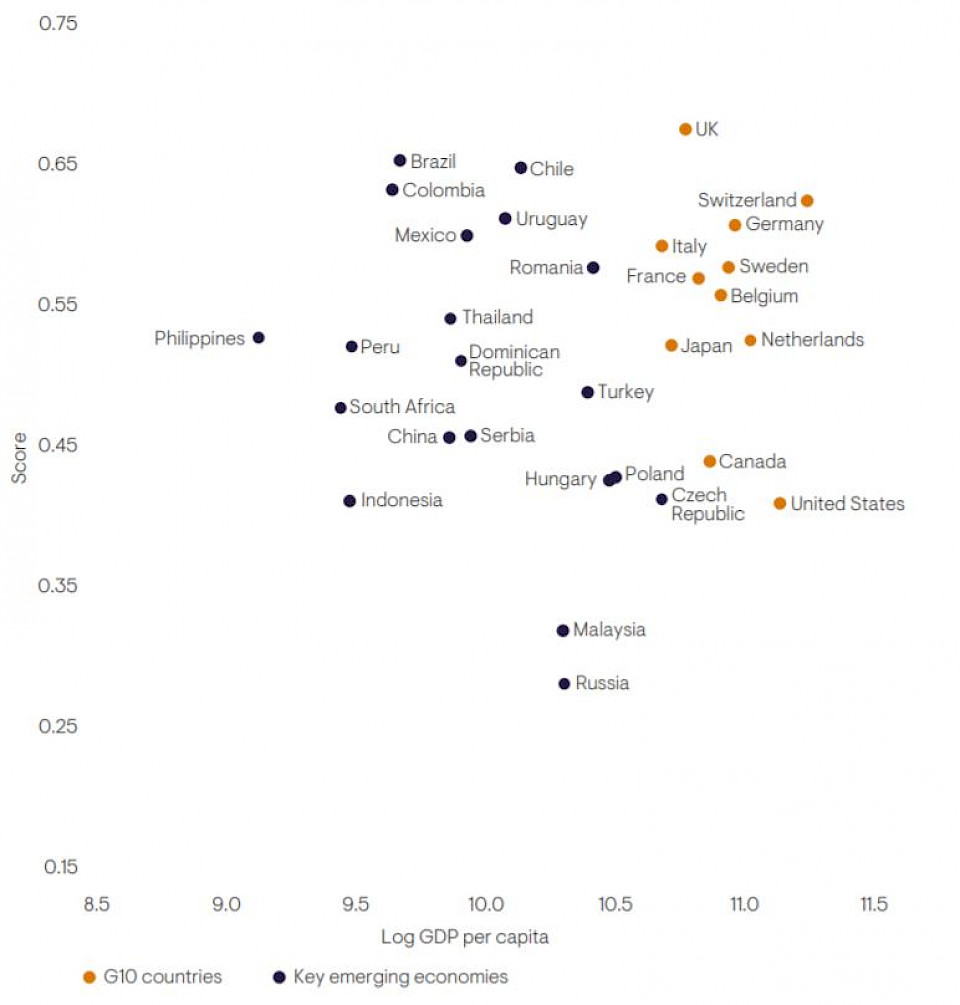

Industrialized countries and emerging economies present very different results in the index (see chart). The United States does the worst in the developed world because of its extremely high emissions and energy consumption levels. The poor starting point and the little progress made so far are responsible for this poor rating. The industrialized Asian countries are also in the lower ranks. Japan is still in the middle, but Korea and Singapore are burdened with a low share of renewable energies and high energy consumption. The United Kingdom and Denmark are the two best performing countries in the index.

“With eight of the top ten countries in the index, emerging economies rank higher than many expected. This shows that many of these countries are leading the energy transition and are able to mobilize capital for decarbonization,” said Erdmann. However, these investments must continue to flow and even have to be increased for the efforts to be sustainable. The index also points to some lagging among emerging markets that are still far from the dynamics required for decarbonization. “These countries need time, encouragement and incentives,” says Erdmanns. “But the detriment is an immediate withdrawal of capital. If these countries take the right approach, good results can be achieved with financing.”

The United States is doing the worst

Source: Germanwatch CCPI. *Based on the components of the G10 Index and JP Morgan GBI-EM GD

“Communicator. Entrepreneur. Introvert. Passionate problem solver. Organizer. Social media ninja.”

More Stories

Great Britain wants to immediately deport asylum seekers without valid documents to Rwanda in the future.

Great Britain wants to increase defense spending to 2.5 percent of GDP

SWR and School of the Future / Journalist Frank Seibert looks for new school models in Dresden, Winnipeg (Canada) and Essen