When Apple introduced the iPhone 6 in 2014, one functionality in particular was the focus: for the first time, users should be able to pay quickly, comfortably, and securely using devices in traditional stores. This is made possible thanks to the new payment system Apple Pay, which also allows online payments using debit and credit cards stored in the Wallet app. A lot has happened since then: Apple’s service is available in more and more countries, and many financial institutions are now participating in the service. A new study now provides interesting numbers for the USA.

When Apple introduced the iPhone 6 in 2014, one functionality in particular was the focus: for the first time, users should be able to pay quickly, comfortably, and securely using devices in traditional stores. This is made possible thanks to the new payment system Apple Pay, which also allows online payments using debit and credit cards stored in the Wallet app. A lot has happened since then: Apple’s service is available in more and more countries, and many financial institutions are now participating in the service. A new study now provides interesting numbers for the USA.

Mobile payment in advance

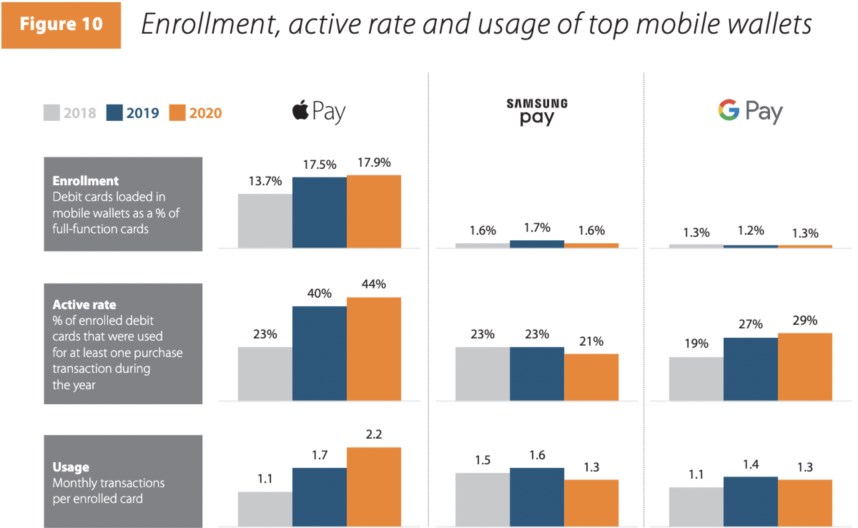

Executed by Pulse study Known as the “Debit Issuer Study 2021”, among other things, payments made via mobile payments are delivering some exciting results: About two billion debit card transactions were made in the US in 2020 via Apple Pay, Google Pay or Samsung Pay . Thus, these three providers recorded a growth of 51 percent over the previous year, although not all of these payment systems benefited from the development to the same extent.

Apple Pay has an acceptance rate of 65 percent in the US

The largest share of payments are made by Apple Pay: 92 percent of transactions are based on Cupertino’s payment system. Amounts paid into wallets by debit card have also grown significantly: While payments averaged $15 in 2019, they reached $23 a year later — an increase of 55 percent. This trend can also be observed in debit card payments in general: the average payment amount in 2019 was $40.50, and in 2020 it was already $44.80. Acceptance of Apple Pay has increased in retail, but there is certainly room for improvement: 65 percent of all US stores offer the option to pay with Apple’s service. Wallets also play an increasingly important role when making payments in an app: 57 percent of transactions were made using this payment system.

“Alcohol buff. Troublemaker. Introvert. Student. Social media lover. Web ninja. Bacon fan. Reader.”

More Stories

Pun: What is the funniest brand name in the UK?

Venezuela is turning to cryptocurrencies for its oil business

Google Privacy Protection Mechanism: Insufficient data protection