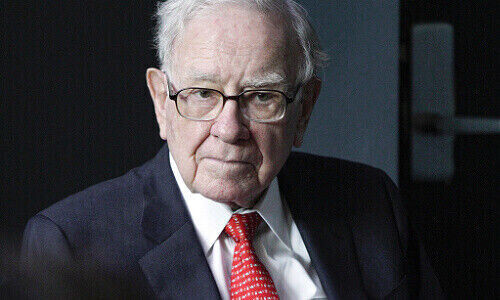

Legendary American investor Warren Buffett has been president of Berkshire Hathaway for 52 years. At the same time, the stock expert is also the CEO of the conglomerate. That should change, according to America’s largest pension fund.

The largest US pension fund wants to vote for a proposal that Warren Buffett as president of Berkshire Hathaway.

How is that The Wall Street Journal I mentioned, you want it California Public Employees Retirement Systemknown as Calpers, an initiative of contributors to National Center for Legal Affairs and Policy Supporting a move to make the position of Chairman of the Board of Directors of the holding company Berkshire Hathaway independent.

‘Weak leadership structure’

After 52 years as chairman, that would prevent Buffett from continuing to lead the company as chairman and CEO. The National Center for Legal Affairs and Policy says in its shareholder initiative that the fact that one person does both jobs weakens the company’s management.

Calpers has more than $450 billion in total assets under management, including nearly $2.3 billion in Class A and Class B Berkshire stock filed with the US Securities and Exchange Commission.

Cult of GM in Omaha

Berkshire Hathaway’s board of directors opposes this measure. He believes Buffett should continue to serve in both roles. Upon his departure, the chair shall be occupied by a non-managing board member.

Buffett, 91, became Berkshire’s CEO in 1965 and has also served as chairman of the board since 1970. He owns 32 percent of the company’s voting rights. After a respite due to the pandemic, the investor legend will once again welcome its shareholders in person this year. The annual general meeting, which has cult status in shareholder circles, will be held on April 30 in Omaha, Nebraska.

Goldman Sachs & Co. has also been criticized

Last but not least, Calpers is also urging Berkshire to provide more information on how the holding company manages climate risk. “In our view, the company’s current information is insufficient,” Calpers said in her request.

The National Center for Legal Affairs and Policy has also launched initiatives to ensure that the Chairman of the Board of Directors of Goldman Sachs, Coca-Cola, Mondelez International, Salesforce.com and Home Depot Inc is appointed as an independent member of its board. Calpers, who is a shareholder in all five companies, did not say whether it would support the proposals.

However, a pension fund generally supports the separation of the CEO and Managing Director roles in all companies in which it holds shares.

“Award-winning music trailblazer. Gamer. Lifelong alcohol enthusiast. Thinker. Passionate analyst.”

More Stories

Primary residence in the USA: Harry turns his back on Great Britain – Culture & Entertainment

Prince Harry: His new main residence is officially the United States of America

Great Britain: Harry Styles' stalker goes to prison – Entertainment